dupage county sales tax rate 2020

DuPage County IL Government Website with information about County Board officials. Beginning May 2 2022.

Dupage County Taxes Tax Rate Information Dupageblog Com

1337 rows Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax.

. It will continue until all delinquent parcels are sold. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the. The December 2020 total local sales tax rate was also 8000.

As a note the average successful interest rate bid at the Tax Sale held in. Illinois has state sales tax of 625 and allows local. DuPage County IL Sales Tax Rate The current total local sales tax rate in DuPage County IL is 7000.

Sales Tax Table For DuPage County Illinois Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 79 in DuPage County Illinois. The December 2020 total local sales tax rate was also 7000. Average Sales Tax With Local.

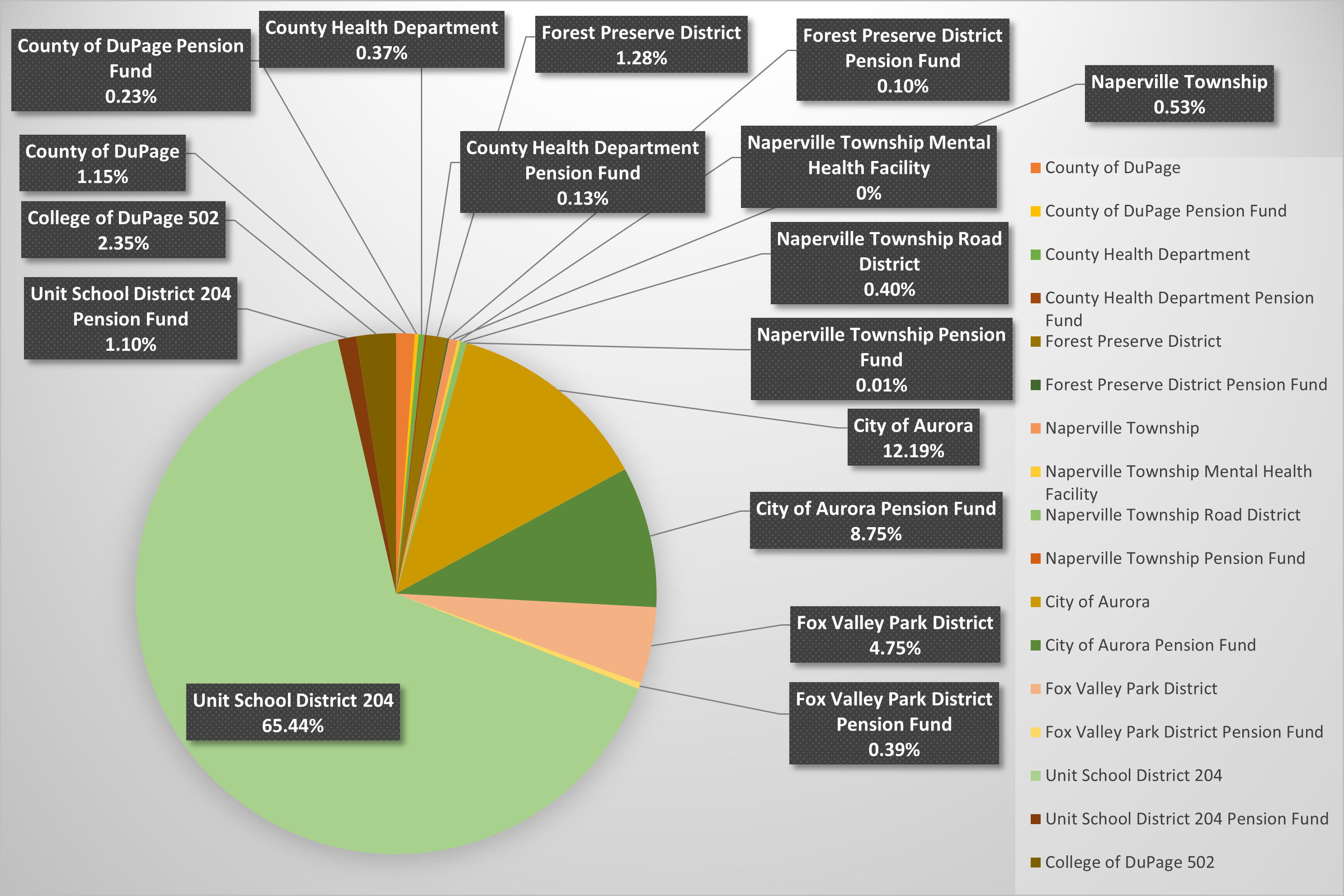

With local taxes the total sales tax. DuPage County collects on average 171 of a propertys assessed. The tax levies are.

County Farm Road Wheaton IL 60187. The December 2020 total local sales tax rate was also 8000. The 105 sales tax rate in Bartlett consists of 625 Illinois state sales tax 175 Dupage County sales tax 15 Bartlett tax and 1 Special.

The sales tax jurisdiction name is. Water Sewer Utility Bills. This is the total of state and county sales tax rates.

111722 Property Tax Sale for unpaid 2021 taxes begins at 900 am. The base sales tax rate in DuPage County is 7 7 cents per 100. The DuPage County Clerks Office calculates the tax rates set within statutory limits for every taxing district in DuPage County.

Addison IL Sales Tax Rate Addison IL Sales Tax Rate The current total local sales tax rate in Addison IL is 8000. The average DuPage tax rate for the 2020 tax season was 73825. 05 lower than the maximum sales tax in IL.

The December 2020 total local sales tax rate was also 7000. 05 lower than the maximum sales tax in IL. The 2021 annual real estate Tax Sale will begin on Thursday November 17 2022.

The 10 sales tax rate in Oak Brook consists of 625 Illinois state sales tax 175 Dupage County sales tax 1 Oak Brook tax and 1 Special tax. DuPage County IL Government Website with information about County Board officials Elected Officials. The minimum combined 2022 sales tax rate for.

The Illinois state sales tax rate is currently. Lombard IL Sales Tax Rate. The December 2020 total local sales tax rate was also 8000.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900.

DuPage County Administration Building. The DuPage County Clerk can verify the interest rate on your sold parcel along with the total amount due. Property Tax Rate and Extension Reports.

Dupage County Illinois Sales Tax Rate 2022 Up to 105 Dupage County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Dupage County does not. The current total local sales tax rate in Lombard IL is 8000. The average EAV for 2020 was 103380 for an average property tax bill of 763203.

Beginning May 2 2022. The minimum combined 2022 sales tax rate for Dupage County Illinois is.

Dupage County Assessment Appeal Cut My Taxes

Illinois Sales Tax Calculator And Local Rates 2021 Wise

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Sales Tax Information Bureau County Government Princeton Il

Dupage County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

Dupage County Il Businesses For Sale Bizbuysell

Transportation Logistics And Warehousing Choose Dupage

Funding Local Pensions With Real Estate Taxes Rub Brillhart Llc

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties

Illinois Sales Tax Rate Changes For Certain Municipalities Including Cook And Dupage Counties Effective January 1 2022

Sales Tax Village Of Carol Stream Il

Dupage County Proposes Seventh Year Of Not Raising Property Tax Rates Illinois Thecentersquare Com

Dupage Gop Dupagecountygop Twitter

About Assessor Naperville Township

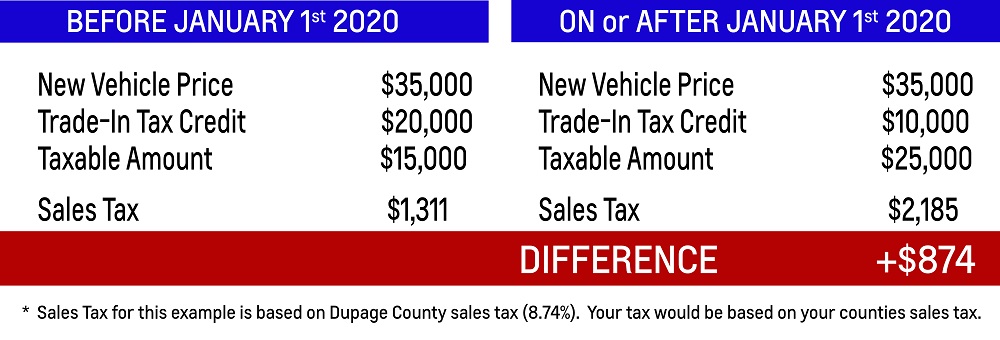

New Illinois Tax Law Deery Brothers Nissan

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

News Updates Dupage County Chairman Dan Cronin

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates