when are property taxes due in lake county illinois

847-377-2000 Contact Us Parking and Directions. Lake County 18 N County Street Waukegan IL 60085.

Lake County Assessors Clash Over Property Value Hikes Lake County Property Values Lake

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes.

. Of the 1930s property tax was the main source of funding for state government. As a courtesy to Lake County taxpayers partial payments will be accepted for the current year taxes. Under Illinois law areas under a disaster declaration can waive fees and change due dates on property taxes.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. Select Tax Year on the right. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

The Lake County Board passed an ordinance for deferred payment of property taxes without penalties as a result of hardship due to the economic fallout from the COVID-19 pandemic. Skip to Main Content. No warranties expressed or implied are provided for the data herein its use or interpretation.

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. Real Estate Tax Calendar. CHICAGO WBBM NEWSRADIO -- Lake County Illinois property owners are getting more time to pay each installment of their property taxes due to impacts of COVID-19.

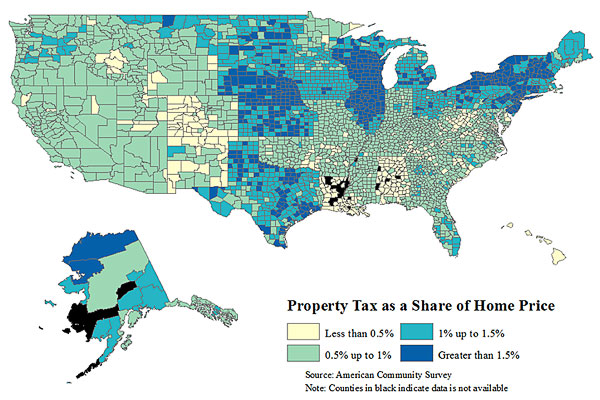

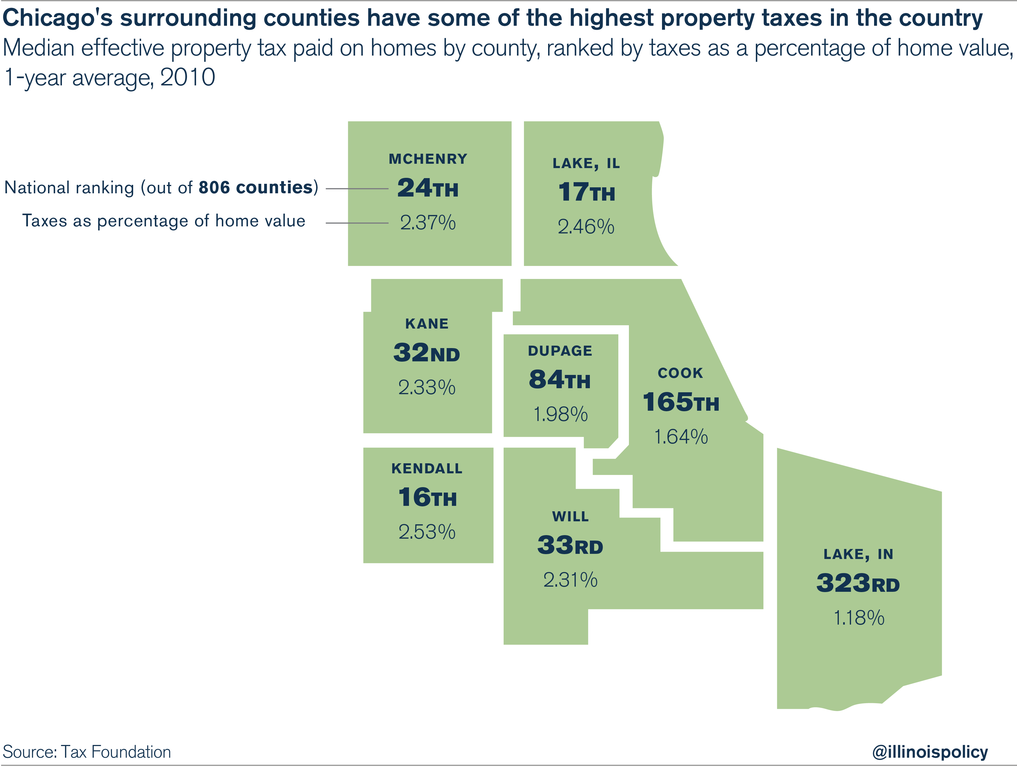

All 102 counties in Illinois are considered disaster areas by both the state and federal governments because of COVID-19. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Lake County has one of the highest median property taxes in the United States and is ranked 15th of the 3143 counties in order of.

Illinois homeowners again paid the nations second-highest property taxes behind New Jersey in the annual. A Right to Challenge and Appeal Your Assessment. 2021 Taxes Payable in 2022.

Find Lake County Online Property Taxes Info From 2021. Lake County collects on average 219 of a propertys assessed fair market value as property tax. Box 328 Dixon IL 61021.

Site Appearance Format Images. The Lake County Property Records and Licensing Office make every effort to maintain the most accurate information possible. Home Departments Treasurer Property Tax Due Dates.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Cook County and some other counties use this. Your property tax dollars help make Lake County a great place to live work and visit.

At its May 12 meeting the Lake County Board passed several measures in response to the COVID-19 pandemic including the property tax extension which allows taxpayers to spread their property. County boards may adopt an accelerated billing method by resolution or ordinance. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. Maps Records Transparency. For this year due dates are June 6th and September 6th therefore the penalty is calculated on the 7th of each month and is not prorated by state law.

Forgiveness of the penalty must be due to. Lake County IL 18 N County Street Waukegan IL 60085 Phone. From the Lake County Treasurers Office.

Tax amount varies by county. Owners rights to timely notice of tax levy hikes are also mandated. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Learn how the county board has kept the tax levy flat for fiscal years 2020. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. Lake County Il Property Tax Information In response to COVID-19 the Lake County Clerks Tax Extension and Redemption Department is open on weekdays as follows.

Ad One Simple Search Gets You a Comprehensive Lake County Property Report. Contact Us Monday-Friday 830am-500pm Location Google Map Website. The median property tax also known as real estate tax in Lake County is 628500 per year based on a median home value of 28730000 and a median effective property tax rate of 219 of property value.

Select Tax Year on the right. 2nd installment due date. Lake County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Skip to Main Content. Lake County Ohio. Select Home Page Menu Image.

Under the ordinance Lake County property owners must still pay the full amount of property taxes due. Access important payment information regarding payment options and payment due dates for property taxes. Real property evaluations are undertaken by the county.

2021 Taxes Payable in 2022. To pay by phone please call 877-690-3729. The exact property tax levied depends on the county in illinois the property is located in.

Lee County does take credit card paymente-check online. Lake County IL 18 N County Street Waukegan IL 60085 Phone. 847-377-2000 Contact Us Parking and.

Property tax bills mailed. 2021 Real Estate Tax Calendar payable in 2022 May 2nd. 847-377-2000 Contact Us Parking and Directions.

The assessors offices are working in the 2021. For example payment for 2019 taxes is due in calendar year 2020. Senior citizen asmt freeze hmsd ex.

Within those limits Lake Forest sets tax rates. Skip to Sidebar Nav. Once you locate your tax bill a pay tax online link will be available.

May 12 2020. When are property taxes due in lake county illinois. Check out your options for paying your property tax bill.

The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. Current Real Estate Tax. Lee County Collector PO.

Last day to pay at local banks. 847-377-2000 Contact Us Parking and Directions. Lake County 18 N County Street Waukegan IL 60085.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. However reserved for the county are appraising real estate sending out bills bringing in the tax engaging in compliance programs and working out conflicts. 105 Main Street Painesville OH 44077 1-800-899-5253.

COLLEGE OF LAKE COUNTY 532. In most counties property taxes are paid in two installments usually June 1 and September 1. 173 of home value.

Notice Of Real Estate Tax Due Dates. Our jurisdiction code is 7042. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe.

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Lake County Real Estate Tax Appeal Estate Tax Lake County Illinois

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

North Central Illinois Economic Development Corporation Property Taxes

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Property Tax City Of Decatur Il

Understanding The Tax Cycle Lake County Il

The Cook County Property Tax System Cook County Assessor S Office

Lisle Township Assessor Lisle Property Tax Tax Rate

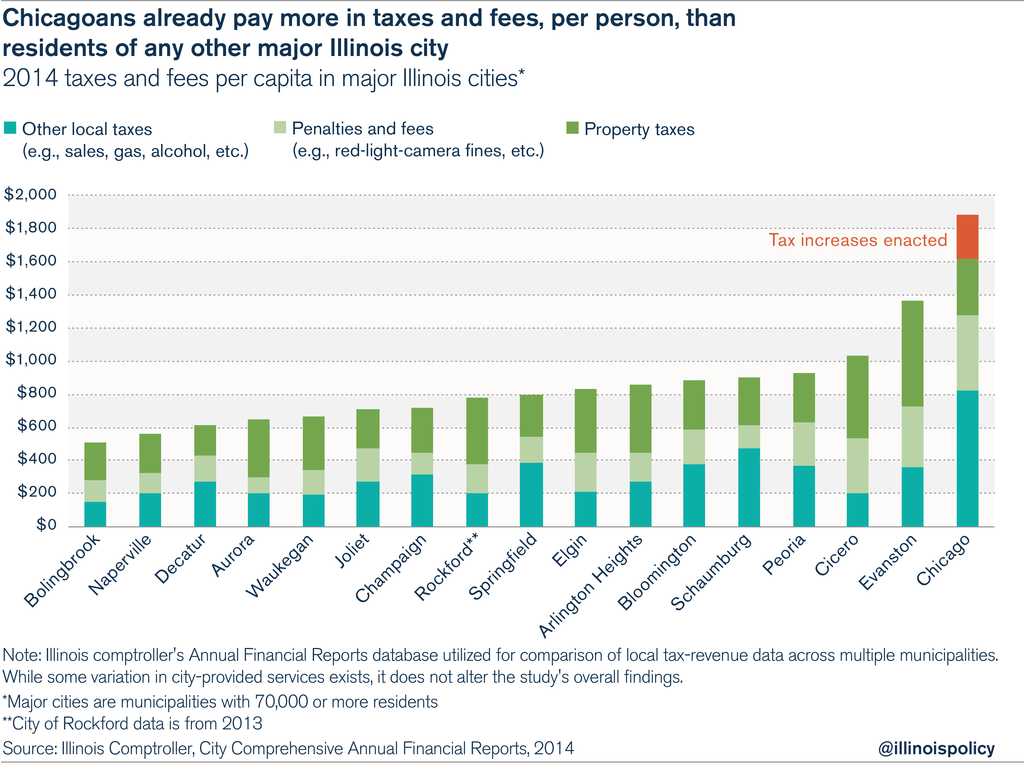

The Chicago Squeeze Property Taxes Fees And Over 30 Individual Taxes Crush City Residents

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Pin By Anne Liveandgrowtoday On Lake County Illinois Agentannecook Com Lake County Ingleside Beautiful Kitchens

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Your 2020 Cook County Tax Bill Questions Answered Medium

The Chicago Squeeze Property Taxes Fees And Over 30 Individual Taxes Crush City Residents

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation